The Most Outrageous Fan Theories They Almost Make SenseFan theories and fan fiction usually stem from heavy cult following of

One major criticism of Hollywood is that it could not seem to cast the proper race in many of the

The world has a total population of 7.9 billion people, and yet, each person’s fingerprint is unique and is not

The Avengers franchise is one of the highest-grossing film series of all time, and has shared its place among legendary

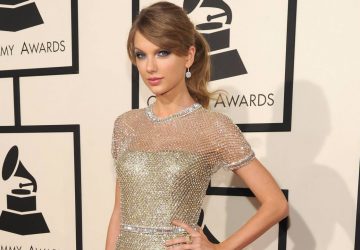

Taylor Swift remains one of the biggest pop stars today, thanks to her incredible musical talent. However, if another thing

Some of the most beloved songs of all time tell what musicians or bands were going through at the time.

Sinister (2012) There aren’t many movies that properly capture the animosity of ghostly terrors reincarnating themselves through the lenses of

Leonardo DiCaprio – The Revenant (2015) The Revenant is the movie that placed DiCaprio’s name on the list of Oscar

If we learn one thing as TV viewers, heartbreaking situations make compelling viewing. It’s not that we want our beloved

No matter how pricey concert tickets get today, fans will always be willing to pay for it. Sure, it may

Lip-syncing has been part of the music performances. No matter how many of them deny it, some are just too

Did you know that the first Grammy Awards was held back in 1959 to honor the musical geniuses for their

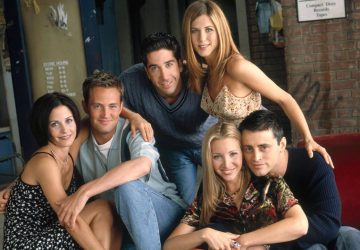

It may have been 17 years since Friends has officially ended, but it cannot be denied that it remains one

Many aspiring actors and actresses are waiting for the right project that will catapult them to an incredible degree of

We all have people we look up to. From parents to siblings to friends to even colleagues, there’s no doubt

To some degree, we can’t stand not interacting with other people; otherwise we get a sense of isolation. Fortunately, thanks

Numerous achievements have been made in the world of technology. From smartphones to self-driving cars, another notable feat would be

To garner a skyrocketing degree in the entertainment industry is a dream many of us want to achieve. Of course,

If there’s one thing we all love to do, it’s performing. Even if it’s just us singing or acting in

At this point, just about everyone uses browses through the internet. Thanks to the ever-continuing advancements in technology, it has

Capturing a picture is a habit that many of us have, especially when we want to preserve a precious moment

There are a bunch of world records out there for the fastest sprint made by man or the world record

Finn – Amanda Seyfried’S Australian Shepherd Actress Amanda Seyfried has always been quite vocal about her love of animals. Aside

Kyle Richards – Diy Hair Coloring Tutorial The Real Housewives of Beverly Hills star posted a video on Instagram of herself in her

Chuck Norris American martial artist, actor, film producer, and screenwriter, Chuck Norris seems to have it all in showbiz and